Budgeting Plan Template For Emergency Funds

Creating an emergency fund is a cornerstone of sound financial planning. It’s your safety net, your buffer against unexpected expenses, and your peace of mind. However, building that fund requires a strategic approach. A budgeting plan template specifically designed for emergency fund accumulation can be a game-changer. This plan provides structure, tracks progress, and keeps you motivated as you work towards your financial security goal.

Why Use a Budgeting Plan Template?

An emergency fund budgeting template provides several key benefits:

- Clarity: It visually maps out your income, expenses, and the portion allocated to your emergency fund. This clarity helps you understand exactly where your money is going.

- Structure: A template provides a structured framework to follow, preventing haphazard saving. It ensures consistent contributions.

- Motivation: Seeing your progress – even small increments – on the template can be incredibly motivating. It reinforces positive financial behavior.

- Accountability: The template acts as a record of your savings efforts, holding you accountable to your goals.

- Identification of Savings Opportunities: Analyzing your income and expenses within the template often reveals areas where you can cut back spending and redirect those funds to your emergency savings.

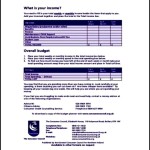

Key Components of an Emergency Fund Budgeting Plan Template

A comprehensive emergency fund budgeting plan template should include the following sections:

1. Income Assessment

This section focuses on identifying all sources of income. Include:

- Net Income: This is your take-home pay after taxes and deductions. It’s the most accurate reflection of the money you actually have available.

- Side Hustle Income: Any income earned from freelance work, part-time jobs, or other income-generating activities should be included.

- Other Income: This might include income from investments, rental properties, or other sources.

Accurately calculating your income is the foundation of your budget. Overestimating your income can lead to unrealistic savings goals and potential shortfalls.

2. Expense Tracking

This section is where you meticulously track all your expenses. Categorize them to gain a clearer understanding of your spending habits. Common expense categories include:

- Housing: Rent or mortgage payments, property taxes, homeowner’s insurance.

- Utilities: Electricity, gas, water, internet, phone.

- Transportation: Car payments, gas, insurance, public transportation fares.

- Food: Groceries, eating out.

- Debt Payments: Credit card payments, student loan payments, personal loan payments.

- Insurance: Health insurance, life insurance, car insurance.

- Healthcare: Doctor visits, prescriptions, dental care.

- Personal Care: Haircuts, toiletries, clothing.

- Entertainment: Movies, concerts, hobbies.

- Miscellaneous: Subscriptions, gifts, other discretionary spending.

Be as detailed as possible when tracking your expenses. Tools like budgeting apps or spreadsheets can help automate this process and provide valuable insights into your spending patterns. Differentiate between fixed expenses (consistent amounts each month) and variable expenses (fluctuating amounts) for better budget control.

3. Emergency Fund Allocation

This is the core of the template. This section dictates how much you will allocate towards your emergency fund each month. Factors influencing this amount include:

- Income Level: Higher income generally allows for larger contributions.

- Existing Debt: If you have significant debt, you might prioritize paying it down before aggressively building your emergency fund, or you may choose to balance both.

- Financial Goals: Consider other financial goals, such as retirement savings or down payment for a house, and how they interact with your emergency fund goal.

- Current Expenses: Assess how much you can realistically cut back on expenses to free up money for savings.

- Target Emergency Fund Size: A common recommendation is to have 3-6 months’ worth of living expenses saved. Determine your target based on your individual circumstances and risk tolerance.

Set a specific, measurable, achievable, relevant, and time-bound (SMART) goal for your emergency fund. For example: “I will save $1,000 per month for the next six months to build a $6,000 emergency fund.” The allocation section should also track:

- Amount Contributed This Month: The actual amount you deposited into your emergency fund.

- Total Emergency Fund Balance: The current balance of your emergency fund.

- Progress Towards Goal: A visual representation (e.g., a chart or graph) showing your progress towards your target emergency fund size.

4. Savings Strategies

This section outlines specific strategies for finding extra money to contribute to your emergency fund. Examples include:

- Reducing Discretionary Spending: Cutting back on non-essential expenses like eating out, entertainment, and subscriptions.

- Negotiating Bills: Contacting service providers to negotiate lower rates for internet, phone, or insurance.

- Selling Unwanted Items: Clearing out clutter and selling items you no longer need.

- Earning Extra Income: Taking on a side hustle or freelance work to boost your income.

- Automating Savings: Setting up automatic transfers from your checking account to your emergency fund each month.

This section serves as a reminder of the actions you can take to accelerate your savings progress.

5. Review and Adjustment

Your budgeting plan should be a living document, not something you set and forget. Schedule regular reviews (monthly or quarterly) to assess your progress and make necessary adjustments. Consider these factors:

- Changes in Income: If your income increases or decreases, adjust your savings goals accordingly.

- Changes in Expenses: Unexpected expenses or changes in your living situation may require adjustments to your budget.

- Progress Towards Goal: If you’re consistently exceeding your savings goals, you may choose to increase your contributions or allocate funds to other financial goals. If you’re falling behind, identify the reasons and adjust your strategies.

Choosing the Right Template

Numerous emergency fund budgeting templates are available online, both free and paid. Choose one that aligns with your needs and preferences. Consider these factors:

- Ease of Use: The template should be intuitive and easy to navigate.

- Customization: The template should allow you to customize categories and calculations to fit your specific circumstances.

- Reporting: The template should provide clear and concise reports that track your progress.

- Format: Choose a format that works best for you, such as a spreadsheet (Excel or Google Sheets) or a dedicated budgeting app.

Building an emergency fund takes time and discipline, but it’s an investment in your financial security. By utilizing a well-structured budgeting plan template, you can gain clarity, stay motivated, and achieve your savings goals. Remember to regularly review and adjust your plan to ensure it continues to meet your needs.

Budgeting Plan Template For Emergency Funds :

Budgeting Plan Template For Emergency Funds was posted in September 27, 2025 at 5:12 am. If you wanna have it as yours, please click the Pictures and you will go to click right mouse then Save Image As and Click Save and download the Budgeting Plan Template For Emergency Funds Picture.. Don’t forget to share this picture with others via Facebook, Twitter, Pinterest or other social medias! we do hope you'll get inspired by SampleTemplates123... Thanks again! If you have any DMCA issues on this post, please contact us!