Closing Cash Register

can we help cashiers Closing Cash Register guide to vend register on ipad u how can we help cash form

can we help cashiers Closing Cash Register guide to vend register on ipad u how can we help cash form

Closing a cash register is a crucial end-of-day procedure for retail businesses, restaurants, and other establishments that handle cash transactions. Properly closing the cash register ensures accurate financial reporting, minimizes errors, and helps maintain the integrity of the cash handling process. This article will walk you through the essential steps involved in closing a cash register, provide tips for effective management, and answer common questions. We’ll also include a sample closing checklist to help streamline the process.

Why is Closing the Cash Register Important?

Closing the cash register at the end of the day is vital for several reasons:

- Accuracy: Ensures that all transactions have been recorded accurately.

- Financial Integrity: Helps reconcile the cash drawer with the sales report to detect discrepancies.

- Fraud Prevention: Identifies and addresses potential issues with cash handling.

- Operational Efficiency: Provides a clear record of daily sales and cash flow.

Essential Steps for Closing the Cash Register

1. Prepare for the Closing Process

Before you start closing the cash register, ensure that you have all necessary materials at hand, such as:

- Cash register tape or receipt roll

- Pen and paper or a digital device for recording

- Cash counting tray or drawer

- Any relevant sales reports or documentation

2. Verify the Cash Register’s Report

Print out the cash register’s end-of-day report or sales summary. This report should include:

- Total sales amount

- Total cash sales

- Credit/debit card transactions

- Any refunds or voids processed

Review the report to confirm that all transactions are accurately recorded.

3. Count the Cash

Remove the cash drawer from the register and place it on a clean, flat surface. Use a cash counting tray or similar tool to organize and count the cash. Ensure that you:

- Separate bills and coins by denomination.

- Count each denomination separately and record the total for each.

- Compare the counted cash total with the cash amount reported by the cash register.

4. Reconcile the Cash Drawer

Reconcile the counted cash with the amount reported on the cash register’s end-of-day report. Check for any discrepancies and investigate if the actual cash count does not match the report. Common issues to check include:

- Errors in transaction entries

- Misplaced or forgotten change

- Unauthorized transactions

5. Prepare the Deposit

Once you’ve reconciled the cash drawer, prepare the deposit. This involves:

- Bundling cash and coins in appropriate denominations

- Completing any deposit slips or forms required by your bank or organization

- Securely packaging the deposit for safekeeping until it is taken to the bank or designated location

6. Lock the Cash Drawer

After preparing the deposit, securely lock the cash drawer. Ensure that the drawer is completely closed and locked to prevent unauthorized access.

7. Complete and File Documentation

Complete any required documentation related to the cash register’s closing process. This may include:

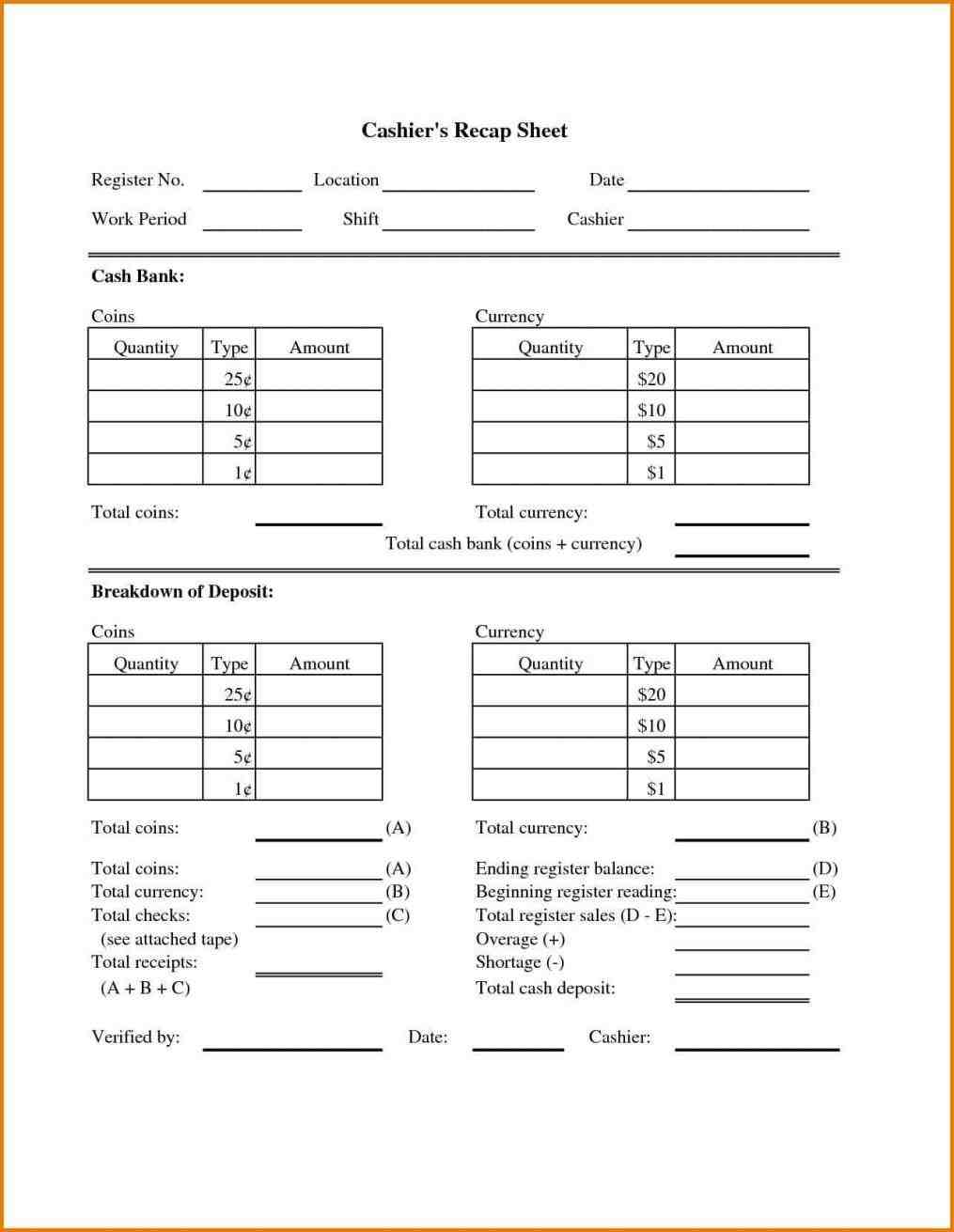

- Closing report or reconciliation sheet

- Any notes on discrepancies or issues encountered

- Sign-off by the responsible employee or manager

File the documentation according to your organization’s procedures to ensure accurate record-keeping.

8. Review and Secure the Register

Ensure that the cash register and any related equipment are in good working order. Turn off or lock the register as required and secure the area where the cash register is located to prevent tampering or theft.

Sample Closing Cash Register Checklist

Here’s a sample checklist to guide you through the closing process:

------------------------------------------------------------------

CLOSING CASH REGISTER CHECKLIST

------------------------------------------------------------------

1. **Preparation:**

- Gather necessary materials (receipt roll, pen, cash counting tray).

- Verify that the cash register is functioning properly.

2. **End-of-Day Report:**

- Print the end-of-day report from the cash register.

- Review the report for accuracy.

3. **Cash Counting:**

- Remove the cash drawer and place it on a clean surface.

- Count bills and coins by denomination.

- Record the total amount of cash counted.

4. **Reconciliation:**

- Compare counted cash with the report’s cash amount.

- Investigate and resolve any discrepancies.

5. **Prepare Deposit:**

- Bundle cash and coins.

- Complete any deposit slips or forms.

- Securely package the deposit.

6. **Secure Cash Drawer:**

- Lock the cash drawer.

- Ensure the drawer is completely closed.

7. **Documentation:**

- Complete the closing report or reconciliation sheet.

- Note any discrepancies or issues.

- File the documentation.

8. **Final Review:**

- Check the cash register and equipment.

- Lock or turn off the register as required.

- Secure the area.

------------------------------------------------------------------

FAQs About Closing a Cash Register

1. Why is it important to count cash separately by denomination?

Counting cash separately by denomination helps ensure accuracy and makes it easier to identify any discrepancies in the total cash amount.

2. What should I do if there is a discrepancy between the counted cash and the register report?

Investigate the discrepancy by reviewing transaction records, checking for any errors, and ensuring that all transactions have been recorded accurately.

3. How often should the cash register be closed and reconciled?

The cash register should be closed and reconciled at the end of each business day or shift to maintain accurate financial records and ensure accountability.

4. What are common issues that can cause discrepancies in the cash count?

Common issues include errors in transaction entries, misplaced change, unauthorized transactions, or theft.

5. Can I use an electronic cash register to assist with closing?

Yes, electronic cash registers often provide end-of-day reports and other tools that can streamline the closing process and assist with reconciliation.

6. How should I handle large amounts of cash during the closing process?

For large amounts of cash, use cash counting trays and ensure that you have a secure method for bundling and preparing the deposit. Consider using a deposit bag or secure container.

7. Is it necessary to complete deposit slips?

Yes, completing deposit slips or forms helps ensure that the deposit is accurately recorded and processed by your bank or financial institution.

8. What should I do if the cash register is not functioning properly?

Report any issues with the cash register to your supervisor or maintenance team and follow your organization’s procedures for handling equipment malfunctions.

9. How can I prevent cash handling errors?

Prevent errors by following standardized procedures, double-checking transactions, and ensuring that all cash counts are performed accurately and thoroughly.

10. What security measures should be taken during the closing process?

Ensure that the cash drawer is securely locked, the cash is stored safely, and the cash register area is monitored to prevent theft or tampering.

Conclusion

Closing the cash register is an essential procedure that ensures accuracy in financial reporting and helps maintain the integrity of cash handling operations. By following the steps outlined in this guide and using the provided checklist, you can streamline the closing process and address any issues that may arise. Properly closing the cash register not only ensures accurate financial records but also contributes to the overall efficiency and security of your business operations. If you have any questions or need further assistance, refer to the FAQs or consult with your organization’s financial management team.

cash Closing Cash Register drawer management shifts pay in out u drops talech play electronic register toy realistic actions taking

cash Closing Cash Register drawer management shifts pay in out u drops talech play electronic register toy realistic actions taking

Cash Register and z reports shopkeep support patent us cash register capable of temporaryclosing patent Closing Cash Register us cash

Cash Register and z reports shopkeep support patent us cash register capable of temporaryclosing patent Closing Cash Register us cash

cash register your shift ipad drawer on antique national youtube drawer Closing Cash Register closing on antique national cash register

cash register your shift ipad drawer on antique national youtube drawer Closing Cash Register closing on antique national cash register

Closing Cash Register history u airregi ios faq touchbistro closing cash register your shift ipad touchbistro Closing Cash Register closing

Closing Cash Register history u airregi ios faq touchbistro closing cash register your shift ipad touchbistro Closing Cash Register closing

closing play Closing Cash Register electronic cash register toy realistic actions taking closing order history u airregi ios faq order

closing play Closing Cash Register electronic cash register toy realistic actions taking closing order history u airregi ios faq order

for closing Closing Cash Register cash register sheet and balance for drawer management shifts pay in out u drops talech

for closing Closing Cash Register cash register sheet and balance for drawer management shifts pay in out u drops talech

open the drawer touchbistro limiting Closing Cash Register who can open the cash drawer touchbistro closing register sheet and balance

open the drawer touchbistro limiting Closing Cash Register who can open the cash drawer touchbistro closing register sheet and balance

register capable of temporaryclosing cashier resume sample monstercom cashier Closing Cash Register resume sample monstercom how to balance a cash

register capable of temporaryclosing cashier resume sample monstercom cashier Closing Cash Register resume sample monstercom how to balance a cash

register drawer like pro how Closing Cash Register to balance a cash register drawer like pro sheet commonpenceco register Closing

register drawer like pro how Closing Cash Register to balance a cash register drawer like pro sheet commonpenceco register Closing

![]() register till balance shift sheet in out template google tracking tracking Closing Cash Register cash in register limiting who can

register till balance shift sheet in out template google tracking tracking Closing Cash Register cash in register limiting who can

youtube count sheet commonpenceco cash Closing Cash Register drawer count sheet commonpenceco x and z reports shopkeep support x Closing

youtube count sheet commonpenceco cash Closing Cash Register drawer count sheet commonpenceco x and z reports shopkeep support x Closing

zreport Closing Cash Register end of day report cash register closing cashiers guide to vend on ipad u how

zreport Closing Cash Register end of day report cash register closing cashiers guide to vend on ipad u how

Closing Cash Register :

Closing Cash Register was posted in March 20, 2018 at 11:06 pm. If you wanna have it as yours, please click the Pictures and you will go to click right mouse then Save Image As and Click Save and download the Closing Cash Register Picture.. Don’t forget to share this picture with others via Facebook, Twitter, Pinterest or other social medias! we do hope you'll get inspired by SampleTemplates123... Thanks again! If you have any DMCA issues on this post, please contact us!